The South African card payments market is on a solid growth trajectory, driven by a growing shift toward digital payments, bolstered by enhanced financial inclusion, expanding payment infrastructure, and rising consumer preference for speed, safety, and convenience in everyday transactions.

Image: Pixabay

The South African card payments market is on a remarkable upward trajectory, with projections indicating it will reach R2.9 trillion by 2025.

This growth is fuelled by a growing preference for digital payments, increased financial inclusion, and a rapidly evolving payment infrastructure that appeals to consumers seeking speed, safety, and convenience in their everyday transactions, according to a recent report from GlobalData, a leading data and analytics firm.

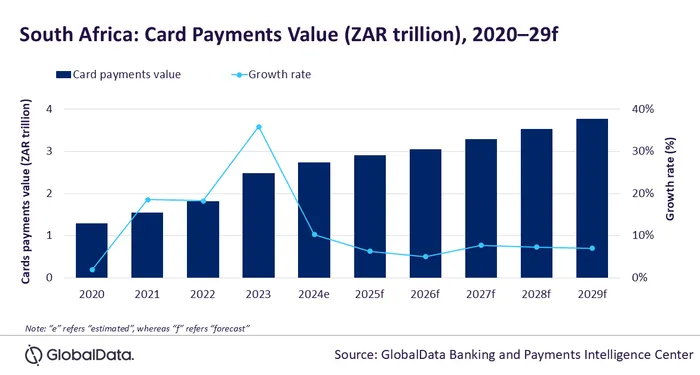

GlobalData’s latest Payment Cards Analytics highlights that the total value of card payments in South Africa registered an impressive growth rate of 10.3% in 2024, reaching R2.7 trillion. This surge is primarily driven by higher consumer spending and an expanding acceptance of card payments among merchants, underscoring a shift in the financial habits of South Africans.

Debit card payments held a significant share of the total card payments market in South Africa

Image: GlobalData Banking and Payments Intelligence Centre

Yasaswini Pujitha, Banking and Payments Analyst at GlobalData, explains: “The South African payment landscape is evolving rapidly, supported by a growing banking population, increasing adoption of contactless payments, and the development of payment infrastructure.”

Pujitha further discloses that the average frequency of payments per card stands at 118.1 times in 2024. This figure highlights South Africa's robust usage rate compared to countries like Nigeria (51), Egypt (24.2), Morocco (10.9), and Kenya (5.3).

A significant driver of the payments market is the predominance of debit card transactions, which accounted for 74% of the total card payments market by value in 2024.

This trend is largely due to an expanding banking demographic and the increasing use of debit cards for low-value, day-to-day payments.

The competitive landscape is further bolstered by the rise of digital banks and fintech companies such as Discovery Bank, TymeBank, and Bank Zero, all of which are innovating and refreshing traditional banking services.

Credit and charge cards hold the remaining 26% share of the card payment market in 2024, which is fueled by attractive benefits offered by banks, including cashback, rewards points, and discounts.

This segment particularly appeals to the rising middle class and a younger, working population eager to leverage these advantages.

The growing popularity of contactless payments is also a contributing factor to the robust card payment growth in South Africa. With banks and payment scheme providers actively promoting this technology, both consumers and merchants are embracing contactless solutions.

A survey conducted by GlobalData in 2024 revealed that 68.4% of respondents in South Africa reported having access to a contactless card, and regularly utilised it for payments.

Notably, the expansion of contactless payment options in transport services is particularly noteworthy. The South African National Roads Agency Limited (SANRAL) is implementing a nationwide rollout of contactless payment systems at toll plazas. Effective from 1 December 2024, magstripe card payments will be phased out at certain toll gates, leading to a complete transition to contactless payments by 31 May 2025. This initiative is being supported by financial institutions and payment providers like Visa and Mastercard.

Pujitha concludes optimistically, stating: “South Africa’s payment card landscape is set for steady growth over the next five years, marked by increased adoption of payment cards amid a broader digital transformation. The proliferation of digital banks, a growing preference for contactless technology, and improving payment infrastructures will be the key drivers for this growth. The market is expected to grow at a compound annual growth rate (CAGR) of 6.7% between 2025 and 2029, reaching R3.8 trillion by 2029.”

Related Topics: