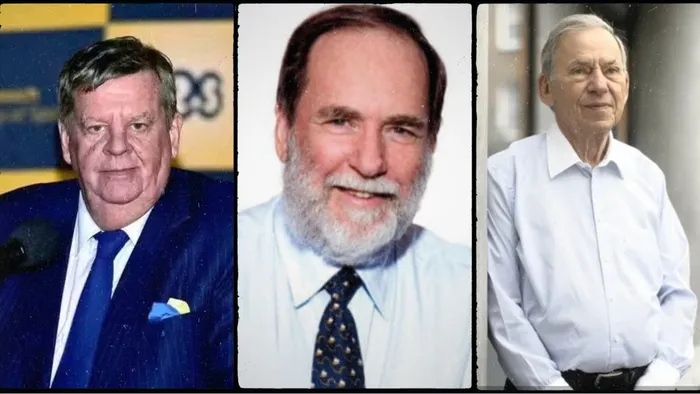

South Africa’s three richest men must be doing something right, because their combined fortunes are up almost $3 billion since the beginning of the year – that’s R53bn.

Image: Se-Anne Rall/IOL

South Africa’s three richest men must be doing something right, because their combined fortunes are up almost $3 billion since the beginning of the year – that’s R53bn.

These gains are despite a huge rout in markets across the world, which has seen the S&P500 lose as much as 5.79% this year, although it was trading almost flat on Tuesday morning. That index, a key American stock exchange, took a beating when US President Donald Trump announced on April 2 that he was imposing massive tariffs on goods brought into the US.

So too did the Nasdaq – which is generally home to tech stocks – lose serious ground, having dropped almost as much as 10% at one stage in the year-to-date period. Like the S&P500, it is also trading flat against the start of the year with peaks and troughs along the way.

US shares were hard hit just after Trump’s April 2 “Liberation Day” statement. The JSE’s All Share index, meanwhile, has escaped almost unscathed, with Peter Little, fund manager at Anchor Capital, stating in a recent note that local stocks started last month in a rout before ending April in positive territory.

South Africa’s local currency, too, is benefitting from a more risk-on approach to investments as the dollar softens on less than favourable US data such as a slight contraction in the economy in the first quarter. On Tuesday morning, it was at R18.26 against the greenback.

In top place among South Africa’s richest according to Bloomberg’s Billionaire Index, is Johann Rupert and his family at 145, which is three positions down since the start of the month.

Rupert, chairman of the Swiss-based luxury goods company Richemont, is worth $15.6bn. His family’s investments are in the world's largest luxury watchmaker, Cie Financiere Richemont, through a family trust as well as other popular luxury brand names such as Jaeger-LeCoultre and Cartier.

Stellenbosch-based Remgro, with stakes in more than 30 companies including Mediclinic and FirstRand, is another of his holdings.

Former De Beers chairman Nicky Oppenheimer is in second place locally at 236. The diamond beneficiary has reversed his previous loss-making position and added $25 million since the start of the year.

Just a week ago, he had lost $300m in the year to end-April. Oppenheimer, who earned $5.2bn in cash in 2012 when he sold his family's 40% stake in De Beers to Anglo American, has investments around the globe including in South Africa, Asia, America and Europe.

Wholesale mogul Natie Kirsh, meanwhile, is at 288 on Bloomberg’s Billionaire list and is worth a staggering $10.3bn. He has added almost $1bn to his fortunes this year through private equity investments and property on four continents.