Africa is seeing a surge in investments from North America, the Middle East, and from mid-sized asset managers and asset owner who are hungry for better yields and risk diversification.

Image: IOL

Investment into Africa is growing as on the back of the negative effects of United States’ President Donald Trump’s imposition of wide-ranging tariffs – which have resulted in that country becoming a less attractive investment destination.

Africa is seeing a surge in investments from North America, the Middle East, and from mid-sized asset managers and asset owners who are hungry for better yields and risk diversification.

The attraction of emerging markets can be seen in the recent relative strength of the rand, which is trading at about $18.25 on general dollar weakness. Anchor Capital’s chief investment officer, Nolan Wapenaar, said: “At the moment,t it is about our strong terms of trade and a returning risk appetite that are the themes we are watching.”

Africa is seeing a surge in investments from North America, the Middle East, and from mid-sized asset managers and asset owner who are hungry for better yields and risk diversification.

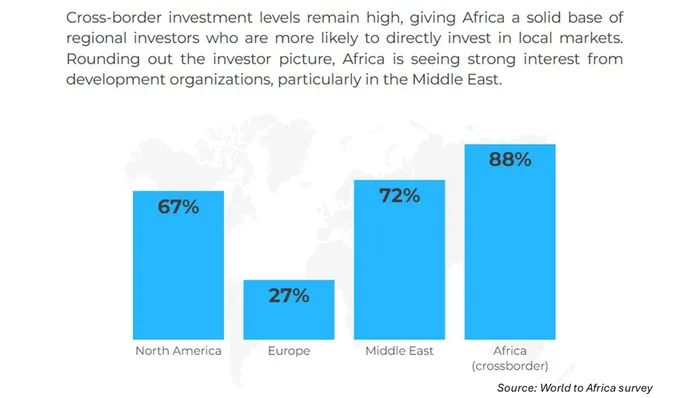

Image: World to Africa Survey

A recent World to Africa survey study by The Value Exchange, in partnership with Standard Bank, showed that 63% of allocators of investments said they invested in Africa in 2024, up from 57% in 2021.

The report, released on Wednesday, showed that billions of dollars are queued for investment into Africa, with half of investors poised to move quickly. “The prospects for growth are immediate and positive,” it said, adding that current inflows were “just the start”.

Trump’s tariffs, announced on April 2, has sparked comment that America’s trading partners, such as Europe and China, will seek out other markets. While the US President announced a 90-day truce the day after what he called “Liberation Day,” this did not apply to China, which faces a total of 245% import duties to the US.

Hari Chaitanya, head of investor services product management at Standard Bank, said “Africa’s growth story is no longer a distant aspiration but a dynamic reality, driven by investment flows, expanding portfolios, and a shift in global perception. With Institutional investors and asset managers at the forefront, the continent is experiencing unprecedented momentum.”

Chaitanya added that a surge in investment flow “underscores Africa’s emergence as a core strategy for global markets, fuelled by its rich resources, growing digital economy, youthful population, and the promise of economic integration through initiatives like African Continental Free Trade Area”.

This comes as Kenyan President William Ruto has called for a revitalised Sino-African partnership, anchored in infrastructure-led development, industrial value chains and minerals beneficiation, that reflects the continent’s rising agency and ambition.

“If the first half of this century belongs to China, the second half will belong to Africa,” Ruto said. There have increasingly been closer political, security and economic ties between China and African nations. Trade between China and Africa increased by 700% during the 1990s, and China is currently Africa's largest trading partner.

Delivering a keynote address at Peking University on his recent state visit to China, President Ruto argued that Africa must seize the moment to shape a new global order founded on mutual respect and strategic cooperation that will benefit the continent.

“This is a time of profound and accelerated global change; within these challenges are opportunities for renewed partnership, bold thinking and a reimagined global architecture,” Ruto said.

“We must not only build the roads and rails of trade, but also the industries and value chains that ensure Africans own a greater share of the economic upside,” Ruto said.

China is now Sub-Saharan Africa’s largest trading partner, with over 3,000 Chinese firms, primarily private sector, operating across the continent. Ruto acknowledged these growing economic ties but cautioned that they must evolve to reflect Africa’s developmental priorities, demographic shifts, and environmental vulnerabilities.

Yet, Ruto has issued a strong critique of global governance institutions, arguing that bodies like the UN Security Council and Bretton Woods institutions have failed to serve the interests of Africa and the Global South. He called for a more democratic, representative and transparent global architecture, one where Africa’s voice carries weight.