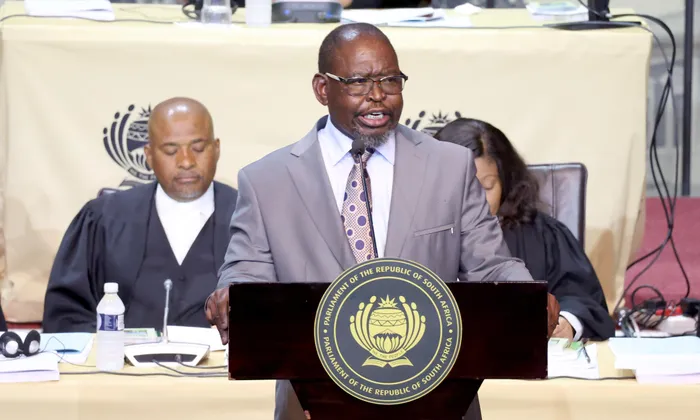

Finance Minister Enoch Godongwana

Image: GCIS/Phando Jikelo

South Africa’s National Budget, which was finally tabled on Wednesday after three previous attempts, is not one in which government seeks to reduce expenditure, Finance Minister Enoch Godongwana said.

However, in seeking to increase revenue for the state’s coffers, the budget proposes an inflation-linked increase to the general fuel levy, said Godongwana. He added that this was “the only new tax proposal that I am announcing” and would be the first fuel levy increase in three years.

Both Old Mutual chief economist Johann Els and Investec chief economist Annabel Bishop expected such an increase, although Bishop had also expected that the duties on tobacco and alcohol would increase.

However, said the Minister, this will not be enough to close the revenue gap. Subsequent budgets will have to find additional revenue sources, said Godongwana.

Before tabling the Budget, Godongwana said that the votes on it needed to happen before the end of July as Departments were running out of money. The Budget was, for the first time in nine years, not physically attended by President Cyril Ramaphosa who joined live from US, where it was 5am in Washington.

“This is not an austerity budget,” said Godongwana. He noted that, instead of cutting back severely on expenditure, it increases non-interest expenditure by an average of 5.4% over three years. In real terms, this is 0.8% growth, the Minister said.

South Africa’s two previous Budget attempts failed to gain approval because of proposed VAT hikes, and markets had been concerned over DA threats to leave the multi-party government. Since then, Cabinet has approved the proposed framework.

Economists had called for expenses to be cut as the removal of the March proposal of 0.5 percentage point VAT hike meant that government would have a R75 billion deficit in revenue.

As a result of the removal of the proposed VAT increase, “the expansion of the zero-rated basket, which was included to cushion poorer households from the VAT rate increase, falls away,” said Godongwana.

In addition, money flowing in from tax has now been revised down by R61.9 billion over the next three years of the Medium-Term Framework. The National Treasury has proposed allocating an additional R7.5bn over the next three years to increase the effectiveness of the South African Revenue Service in collecting more revenue.

On Wednesday, Godongwana said the National Budget was a redistributive budget.” It directs 61 cents of every rand of consolidated, non-interest expenditure towards the social wage. This is money that will be spent to fund free basic services like electricity, water, education, healthcare, affordable housing, as well as social grants for those in need,” he said.

This budget invests over R1 trillion in critical infrastructure to lift economic growth prospects and improve access to basic services, Godongwana said. He added that this is done without compromising the fiscal strategy of sustainable public finances.

However, government has achieved its balancing act by reducing additional spending over the medium term by R68bn. “Simply put, this means baseline allocations across all spheres of government remain largely unchanged. Instead, the size of the proposed increases to allocations is reduced, in line with what we can afford,” said Godongwana.

Economists had been concerned about frontline investment being cut, such as additional teachers and nurses.

Godongwana added that the government would continue to pay large amounts to service debt, which would amount to more than R1.3 trillion over the next three years. “Put differently, this means in 2025/26 alone we are spending around R1.2 billion per day to service our debt,” he said.

Related Topics: