Money is moving into gold as US President Donald Trump's tariffs take effect.

Image: Ron | IOL

When the only economic certainty is uncertainty, and US President Donald Trump’s 30% trade tariffs came into effect today, investors are rethinking their strategies and shifting their money into gold, tech stocks, or cash – a move towards resilience and diversification.

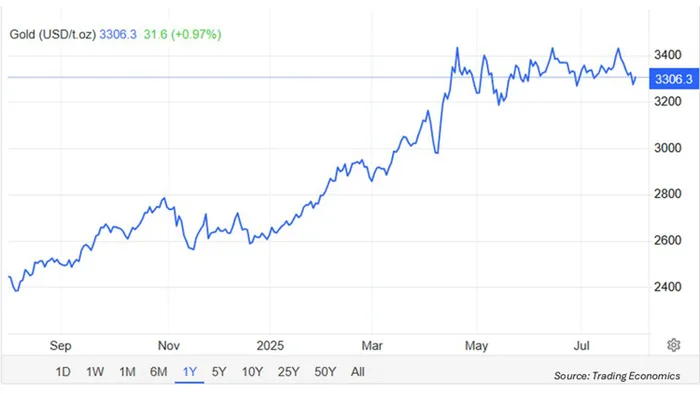

According to gold trading platform ISA Gold, the year-on-year price of gold has surged, reaffirming its role as a strategic hedge against economic instability. Those who bought bullion in July 2024, amid a weakening rand and turbulent global markets, are now enjoying double-digit returns.

"Clients who secured Krugerrands or gold bars through our platform last July are seeing portfolio gains that outpaced inflation and equities, proof that physical gold remains an essential part of any diversified investment strategy," said Aziz Moti, COO at ISA Gold. The yellow metal has gained about 42.33% in a year.

Moti believes the rally is underpinned by global uncertainty, geopolitical tensions, a weakening US dollar, and strong central bank purchases. "Central banks have been on a buying spree, and that has only added to gold’s momentum," he noted.

Goldman Sachs recently raised its year-end 2025 forecast for gold to $3,700 per troy ounce, up from the current $3,305, citing sustained central bank buying and ongoing safe-haven demand.

In a more bullish scenario – should central banks ramp up purchases or the US slip into recession – the price could hit $3,880 per ounce, said Moti. By Thursday afternoon, gold was already up 6.25% for the year.

“There continues to be a notable uptick in gold investment through exchange-traded funds, digital platforms, and physical bullion. This is not a short-term reaction. Investors are looking for security, legacy, and tangible value,” Moti said.

While gold remains the ultimate safe haven, data from BrokerChooser shows that market anxiety is spreading across asset classes. Searches for “is Trump good for the stock market” have jumped 170% in the past month, while “should I sell Tesla stock now” soared by more than 5,000% after Trump publicly clashed with Elon Musk.

South Africans are also closely watching the so-called “Magnificent Seven” tech stocks. Nvidia, Tesla, and Tencent – partly owned by local giant Naspers – dominate interest, with Microsoft and Meta also winning favour after strong quarterly results.

Gold continues to glitter

Image: Trading economics

According to CNN, “the economy was supposed to crumble. The trade war was expected to escalate out of control. Markets were forecast to plunge. None of that happened – at least, not yet.”

PPS Investments warned that while the full effect of Trump’s tariffs is unclear, growth in the US could slow as higher import costs push up inflation. It favours domestic cash and yield-enhancing floating-rate notes while maintaining a neutral stance on offshore equities and fixed income, with gradual diversification away from the US. This, it says, should help investors limit the whipsaw effect of market reactions to tariff headlines.

For Moti, gold’s appeal is rooted in its track record. “Gold has outperformed currencies for decades and weathered world wars, recessions, and a pandemic. Even as cryptocurrencies grow in popularity, gold continues to hold its ground as the traditional safe-haven asset,” he said.

Bloomberg Intelligence supports this view, noting that institutional investors still regard gold as a hedge against long-term inflation and geopolitical risk, while crypto remains a high-risk, speculative play.

As Trump’s tariff storm intensifies, it seems the smart money is spreading its bets.