Co-founder and Chief Executive of Oracle Corporation, Larry Ellison. REUTERS/Stephen Lam/Files

Image: REUTERS/Stephen Lam/Files

Oracle shares surged about 43% to a record high on Wednesday, putting the company on track to join the elite trillion‑dollar club, after it showcased its rise as a major AI cloud provider.

The company unveiled four multi-billion-dollar contracts earlier in the week, amid an industry-wide shift, led by companies such as OpenAI and xAI, to aggressively spend to secure the massive computing capacity needed to stay ahead in the AI race.

The stock was up 42.8%, hitting a record high of $345.49, set for its biggest one-day percentage jump since 1992.

Oracle co-founder and chairman Larry Ellison, 81, whose net worth is largely derived from his 41% stake in Oracle, saw his fortune rise to around $395 billion, according to Forbes.

The rise in Oracle's shares means Elon Musk can no longer claim the title of the world’s richest man; that title now belongs to Ellison, who made $101 billion on Wednesday.

Musk's wealth sits at $385 billion, Bloomberg reports.

The company will add about $299 billion to its market valuation, taking the total valuation to around $969 billion, if gains hold, and bringing Oracle closer to the coveted $1 trillion-dollar club.

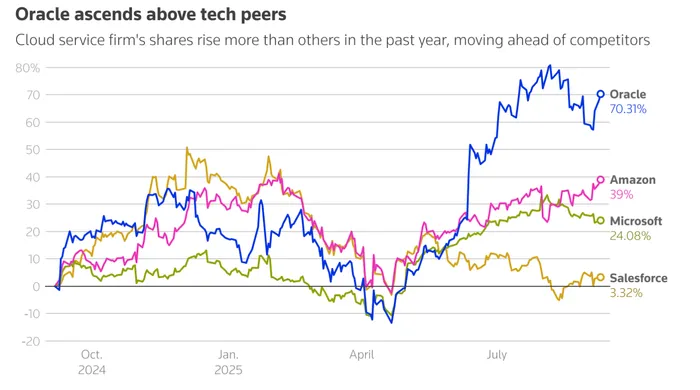

Its shares have risen 45% so far this year, outperforming the so-called Magnificent Seven stocks and the broader S&P 500 index, with investors betting big on AI-driven cloud firms.

Oracle’s stock rises more sharply than others over the year, moving ahead of its competitors.

Image: SLEG

Over the next few months, we expect to sign up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars," said CEO Safra Catz during a post-earnings call.

Currently, Microsoft, Amazon Web Services and Google Cloud dominate the cloud computing market with a combined 65% share, while Oracle, Alibaba, CoreWeave and others hold a smaller slice of the market.

Oracle's first-quarter results lifted shares of Nvidia, Broadcom and Advanced Micro Devices, which supply semiconductors used in data centres.

Shares of the companies rose between 3.8% and 10.6%.

The company has struck deals with Amazon, Alphabet and Microsoft to let their cloud customers run Oracle Cloud Infrastructure (OCI) alongside native services.

The revenue from these partnerships rose more than sixteenfold in the first quarter.

"What matters here is that this figure now includes contributions from the Stargate venture and two other big AI players, meaning revenues beyond 2026 go much higher," said Ben Reitzes, analyst at Melius Research.

Analysts flagged Oracle's role in SoftBank and OpenAI's Stargate project as another tailwind, giving the company a foothold in the large-scale AI infrastructure project that is expected to channel about $500 billion in spending.

The company also supplies cloud services to xAI, the AI startup founded by Musk, a longtime ally of Ellison.

-Additional reporting by Vernon Pillay

FAST COMPANY