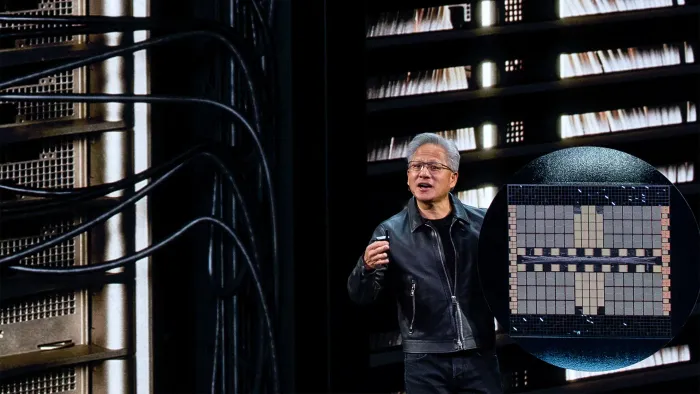

Nvidia CEO Jensen Huang

Image: Kent Nishimura/Bloomberg via Getty Images

Nvidia Corporation became the first company to cross the $5 trillion valuation in premarket trading this week.

It marks a major milestone in stock market history and suggests that once other unthinkable valuations are within reach.

But Nvidia isn’t the only company breaking a trillion-dollar threshold. Fellow tech giants like Apple, Meta, and Broadcom are close to bursting their own thirteen-figure barriers, too.

Here’s what you need to know about Nvidia’s approach to $5 trillion as companies climb toward the most exclusive club on the planet.

As of this writing, Nvidia has become the first company to cross the $5 trillion valuation threshold. In premarket trading, NVDA shares are currently up 3.65% to $208.37 per share.

With about 24.3 billion shares outstanding, that gives Nvidia a current premarket valuation of just over $5 trillion. If Nvidia’s stock price levels hold once the opening bell rings, it will cement its place in the record books.

The company’s current premarket jump follows the stock’s nearly 5% rise yesterday. These gains have been primarily driven by recent announcements from the company that are lifting investors’ expectations.

As CNBC notes, Nvidia announced plans yesterday to build seven new supercomputers for the U.S. government, including at Los Alamos National Laboratories.

Separately, Nvidia CEO Jensen Huang revealed that the company’s all-important Blackwell GPUs are now in full production in the U.S. state of Arizona. This allows Nvidia to manufacture more of its AI chips, which can help meet the incessant demand for its processors.

But there’s another factor that may be motivating Nvidia investors. As Reuters reports, President Trump is in Asia this week, meeting with regional leaders. He is due to meet with Xi Jinping, China’s President, tomorrow.

Today, Trump revealed that he will speak to the Chinese president about Nvidia’s Blackwell chips, which are currently banned in the country. A lifting of this ban could greatly boost Nvidia’s bottom line if the company can once again sell its Chips inside China.

Investors seem to feel that this trio of positive news has the chance to materially benefit the company, hence, the $5 trillion barrier is falling.

Nvidia’s $5 trillion milestone isn’t the only thirteen-figure barrier that is being broken this week.

Yesterday, Apple Inc. (Nasdaq: AAPL) officially crossed the $4 trillion barrier for the first time, before closing the day with a market valuation of $3.99 trillion.

Apple’s accession into the $4 trillion club made it just the third company in history to cross that barrier, after Nvidia and Microsoft Corporation (Nasdaq: MSFT).

While nothing is certain, it’s possible Apple could cross back over the $4 trillion threshold again today.

And Apple and Nvidia aren’t the only companies within reach of crossing trillion-dollar thresholds. Two other companies are within range, too.

Facebook owner Meta Platforms (Nasdaq: META) had a market cap of $1.88 trillion as of yesterday’s close. That means it’s less than $120 billion from crossing the $2 trillion barrier, which would be a first for the company.

Semiconductor and internet infrastructure company Broadcom Inc. (Nasdaq: AVGO) is also relatively close to crossing a trillion-dollar barrier.

As of yesterday’s market close, Broadcom had a market cap of $1.76 trillion. That puts it at less than $250 billion from the $2 trillion club.

Of course, while these companies are closest to their next trillion-dollar barriers, there’s no guarantee that their stocks will continue to go higher, or, if they do, how long it will take.

But their ascent up the ranks is another example of how once unthinkable trillion-dollar market caps are becoming more common.

For those keeping track, there are now 11 trillion-dollar publicly traded companies, based on yesterday’s share prices at market close, according to data compiled by CompaniesMarketCap.com.

Those companies are:

It will be interesting to see how the current tech earnings season will impact the market caps of many of these companies.

Investors will particularly be interested in how the artificial intelligence boom is affecting the bottom lines of companies like Microsoft, Alphabet, and Meta, all three of which are expected to report their financial results after the closing bell today (Wednesday, October 29).

Wall Street will also be watching for any updates from these companies about their capital expenditure plans, as the AI boom has required huge investments from the world’s largest tech giants.

If investors are satisfied that AI investments are worth the costs—and if they don’t see signs of a slowdown—share prices could spike, sending them further up the ranks into the trillion-dollar club.

But if investors begin to worry that we are, as many have speculated, in an AI-fueled bubble, many of the companies in the trillion-dollar club could see their rankings slip fast as their share prices fall.

ABOUT THE AUTHOR

Michael Grothaus is a novelist and author. His latest novel, Beautiful Shining People, has been translated into multiple languages.

FAST COMPANY