.

Image: REUTERS/File Photo

Tesla's board of directors has pushed all its chips on Elon Musk. Now investors must decide whether to back the biggest bet in company history.

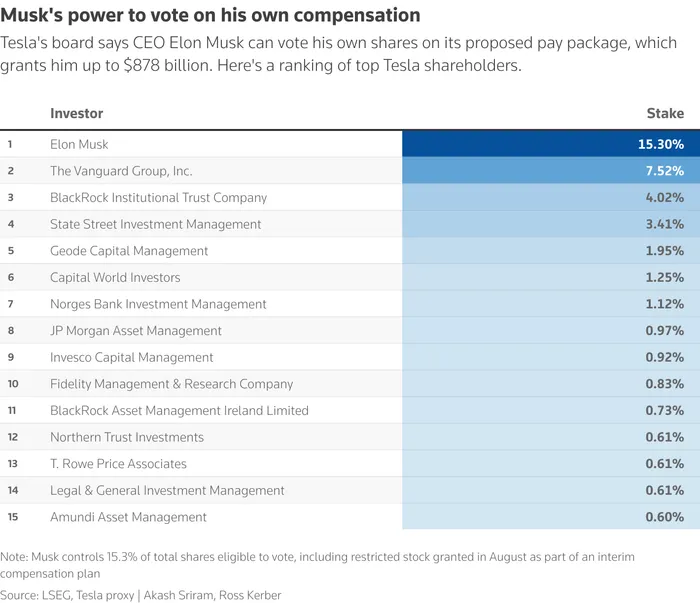

Shareholders will vote Thursday on the stark choice presented by the board: pay Musk up to $878 billion in company stock or take the risk he will leave, potentially driving down the company’s stock.

The decision, experts say, amounts to a referendum on whether traditional corporate-governance rules apply to the world's richest man.

The board and many investors argue that only Musk can deliver on his promises to transform Tesla into an artificial-intelligence juggernaut delivering millions of self-driving robotaxis and humanoid robots.

If Musk hits all the board’s performance goals within a decade, Tesla’s market value will have grown to $8.5 trillion – with Musk owning about a quarter of the stock.

That is exponentially more compensation than any other CEO, and Musk would still collect record payouts – tens of billions – if he misses most performance goals.

Many investors are not blinking at the eye-watering sums.“If the stock is going to go up sixfold – and that’s a requirement here – then I’m going to make a lot of money,” said Nancy Tengler, CEO and chief investment officer of Laffer Tengler Investments, a Tesla investor.

“Why do I care what kind of money he makes if he’s affecting the change and the vision?”

Other major shareholders and executive-pay experts warn that the proposal represents an enormous risk to investors.

The package, experts said, flouts governance principles not only because of its size but because the board is so explicitly staking Tesla’s future on one leader, with myriad conflicts of interest, who stands to consolidate unchecked power over the company.

Responsible governance, they argue, requires boards to remain open to a competitive market for the best available CEO at any given time.

Musk did not respond to requests for comment. A spokesperson for Tesla's board declined to comment.

.

Image: Reuters

Musk told board members during negotiations that he might prioritise his many other ventures – including rocket firm SpaceX, artificial-intelligence startup xAI and brain-implant firm Neuralink – unless they came to terms.

And board chair Robyn Denholm has repeatedly emphasised the risk of losing Musk in selling shareholders on his compensation.

Charles Elson, founding director of the Weinberg Center for Corporate Governance at the University of Delaware, said Tesla’s board is being “held over the barrel by a 'superstar CEO.'”

“To me the appropriate answer is to say, ‘Have a good day,’” Elson said.Major shareholders including the biggest U.S. public pension fund, the California Public Employees' Retirement System (CalPERS), and Norway’s sovereign wealth fund echoed those concerns in publicly opposing Musk’s compensation. Norges Bank Investment Management said on Tuesday the pay proposal could dilute shareholder value and failed to mitigate the “key person risk” in staking Tesla’s future on Musk.

The board sought to ensure Musk’s longevity in company leadership with provisions including stock vesting periods.Krishna Palepu, a professor at Harvard Business School focusing on corporate governance, said the proposal aligns with shareholders' interests by tying Musk’s compensation to large stock-value increases and requiring him to hold the shares he earns for five years.

Musk, he said, has a track record of achieving extraordinary stock-price growth and would receive the largest payouts only if he does it again.

"The numbers are big because the goals are big," Palepu said.

FAST COMPANY