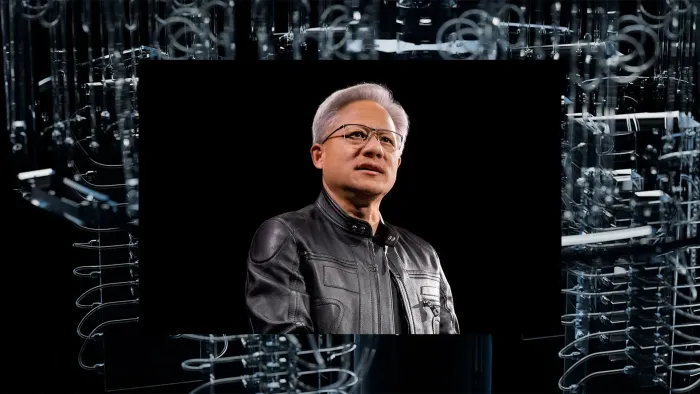

Nvidia CEO Jensen Huang

Image: Nvidia

The most anticipated quarterly earnings of the month will be announced today, as AI chip giant Nvidia Corporation reveals its financial results for its 2026 fiscal third quarter.

A lot is riding on these results, and not just for Nvidia.

Investors are increasingly on edge about a possible AI bubble, and if Nvidia posts good or better-than-expected earnings, it could give those investors faith that AI infrastructure is on solid ground and has plenty of room to grow.

But if Nvidia’s earnings disappoint—or show signs of upcoming weakness—it could spell bad news not just for NVDA stock, but for the stock prices of all companies operating in the AI space.

Here is what Nvidia has previously forecast for its Q3 2026, and what investors are expecting when the company releases its earnings results tomorrow after markets close.

On August 27, Nvidia announced its Q2 2026 results. That same day, the company released its forecast for the quarter that it is currently operating in. Here is what the company said it expected for its Q3 2026, which ran from July 28 to October 26:

Nvidia’s estimates above are the best guess the company had for its Q3 based on the data it had at the time, which in this case was in August.

But analysts calculate their own estimates, which fluctuate as the quarter progresses and additional data is assessed. That’s why analyst estimates will typically not entirely align with what a company has forecast.

Also, nearly every individual analyst will have a different estimate. These estimates are often pooled to produce a consensus figure, and yet even those consensus figures will differ depending on what analysts are included.

The number that analysts usually care most about is revenue. Nvidia forecast its Q3 2026 revenue to come in at $54 billion plus or minus 2%, which would equate to a range of roughly $52.9 billion to $55 billion.

Here’s what analysts are expecting:

As you can see, three separate analyst roundups show that Wall Street expects Nvidia to come in at the high end of its $52.9 billion to $55 billion Q3 revenue estimate.

That means that if Nvidia doesn’t meet these lofty expectations, investors could get spooked and the stock could drop.

But a miss in these revenue estimates could also add fuel to the fire over growing concerns that the AI sector is in a bubble. And if Nvidia’s results fuel bubble fears, the company’s earnings could have an adverse knock-on effect on the stock prices of other companies operating in the space.

Nvidia’s shares have been strong so far in 2025. As of yesterday’s close, the stock is up more than 38% for the year. And back in October, Nvidia made history when its share price rose to as high as $212, making Nvidia the world’s first public company ever to be valued at $5 trillion.

But since then, the company’s stock has fallen almost 10%. In the run-up to its Q3 earnings tomorrow, investors are hoping that strong results will mean that NVDA shares can make back some of those losses.

Most of the so-called Magnificent Seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla) are down over the last five days, as is the tech-heavy Nasdaq Composite.

ABOUT THE AUTHOR

Michael Grothaus is a novelist and author. His latest novel, Beautiful Shining People, has been translated into multiple languages.

FAST COMPANY