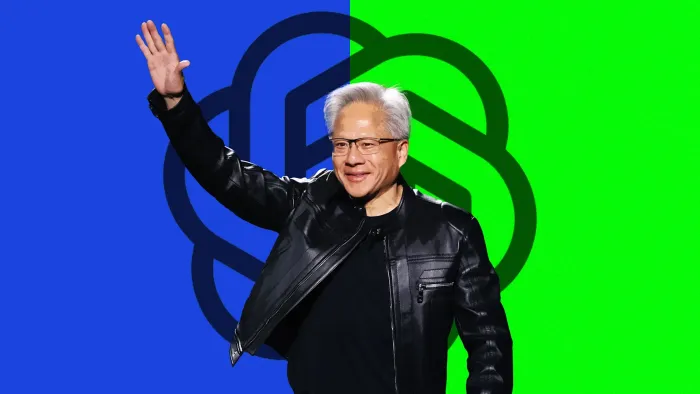

Co-founder and chief executive officer of Nvidia Corp, Jensen Huang

Image: Chesnot/Getty Images

Wake up to the shifts shaping the future.

From boardroom shakeups and billion-dollar bets to the latest tech breakthroughs rewriting the rules, The Company Brief is your front-row seat to the stories moving markets and mindsets.

We cut through the noise so you can stay ahead of the curve, one bold business move at a time.

Nvidia's strong forecast calms AI bubble jitters

Nvidia CEO Jensen Huang on Wednesday shrugged off concerns about an AI bubble as the company surprised Wall Street with accelerating growth after several quarters of slowing sales. The chipmaker's stellar third-quarter earnings and fourth-quarter forecast calmed, at least temporarily, investor nerves over concerns that an AI boom has outrun fundamentals. Global markets have looked to the chip designer to determine whether investing billions of dollars in AI infrastructure expansion has resulted in an AI bubble. Shares of the AI market bellwether jumped 5% in extended trading, setting up the company to add $220 billion in market value. Ahead of the results, doubts had pushed Nvidia's shares down nearly 8% in November, after a surge of 1,200% in the past three years.

US, Saudi Arabia tout new business deals at investment forum

Saudi and U.S. officials touted billions of dollars in new investments and growing financial ties between the two countries on Wednesday, coinciding with Saudi Arabian Crown Prince Mohammed bin Salman's first visit to Washington since 2018. Sitting next to Trump in the White House, bin Salman on Tuesday had promised to increase his country's U.S. investment to $1 trillion from a $600 billion pledge he made when Trump visited Saudi Arabia in May. But he offered no details or timetable. On Wednesday, President Donald Trump, who spoke at a U.S.-Saudi business forum, pushed bin Salman to go higher. "Could you make it $1.5 trillion?" he asked. Trump and bin Salman applauded $270 billion in agreements and sales signed between dozens of companies at the Kennedy Centre conference, including planned purchases of 600,000 Nvidia AI chips by HUMAIN, a government-backed Saudi AI firm. HUMAIN and Elon Musk's xAI will also jointly develop data centres in Saudi Arabia, including a 500-megawatt facility.

Yann LeCun launches an AI startup focused on Advanced Machine Intelligence

Yann LeCun, one of the founding figures of modern artificial intelligence and a pivotal force at Meta Platforms, said on Wednesday he plans to leave the company at the end of the year to launch a new AI startup. LeCun has been a key part of Meta's artificial intelligence ambitions for more than a decade. He joined the company in 2013 to create Facebook AI Research (FAIR), the in-house lab that helped transform Meta into one of the AI leaders. He said his new venture will pursue Advanced Machine Intelligence (AMI) research, a project he has developed in collaboration with colleagues at FAIR and New York University, where he teaches.

DeepSeek pushes hard in Africa

The Chinese AI firm DeepSeek (backed by the High-Flyer hedge fund) is rolling out its DeepSeek-R1 chatbot across African countries, often via partnerships with Huawei, according to the Africa Defence Forum. It’s being pitched as a far cheaper alternative to Western AI models like ChatGPT. DeepSeek charges “about 94% less” than ChatGPT for processing requests, and this low cost makes it attractive for African startups and institutions that lack the infrastructure or budget to use more expensive models. Critics have questioned the fact that user data (chat histories, prompts, location) is stored on servers in China and is reportedly accessible by the Chinese government.