Corolla Cross Hybrid

Image: Toyota

On World EV Day, much of the globe is celebrating the rise of fully electric cars. But in South Africa, the real disruptor isn’t the battery-electric vehicle, it’s the humble hybrid.

According to AutoTrader’s latest Mid-Year Industry Report, New Energy Vehicle (NEV) sales surged 82% year-on-year, with conventional hybrids making up a commanding 84% of the segment between January and June 2025.

While electric vehicles (EVs) continue to make headlines globally, in South Africa, hybrids are proving to be the technology that aligns best with local realities.

At the heart of this transition is Toyota’s locally built Corolla Cross Hybrid, the country’s top-selling NEV and a symbol of how affordable innovation can accelerate adoption.

With 700 units sold in six months, it outpaced not only imported EVs but also most premium hybrids. Its appeal lies in combining electric assistance with traditional petrol power, eliminating range anxiety while still cutting fuel consumption.

This “best of both worlds” design is the real innovation. Hybrid systems use regenerative braking, electric assist, and start-stop technology to deliver meaningful efficiency gains without the need for South Africa’s still-fragile charging infrastructure. By comparison, battery-electric vehicles (BEVs) saw a healthy 65% YoY increase, but with just 64 sales of the Volvo EX30, the country’s top-selling EV the gap is stark.

“What’s happening in South Africa isn’t just a shift in vehicles, it’s a shift in mindset," George Mienie, the CEO of AutoTrader noted.

"Buyers are seeking solutions that balance practicality with sustainability. Hybrids prove that the path to cleaner mobility doesn’t have to compromise everyday life, or break the bank.”

Toyota remains the dominant force in the segment, with the RAV4 Hybrid (177 units sold) and other models like the Hilux and Fortuner offering mild hybrid systems that enhance efficiency without requiring plug-in charging. Even Lexus, Toyota’s luxury brand, features in the top 10, alongside Volvo’s XC90 plug-in hybrid.

Chinese automakers are also making bold moves, with Haval, GWM, and newcomers like Chery and Omoda entering the hybrid and EV market. Their growing presence signals increased competition, innovation, and accessibility in the months ahead.

South Africa’s unique challenges, load shedding, limited charging infrastructure, and cost sensitivity make hybrids an attractive option. They bridge the gap between petrol and fully electric vehicles by offering:

Lower upfront costs: Average used hybrid prices are 39% cheaper than EVs.

Practical efficiency: Small electric motors reduce fuel consumption and emissions without range compromises.

Infrastructure flexibility: No dependence on public charging, yet a clear step toward electrification.

Even though the average price of used hybrids ticked up by 3% YoY (to R696,169), affordability relative to EVs keeps them within reach for more consumers.

Globally, EV adoption is accelerating, China accounts for nearly two-thirds of global sales, while Europe (17%) and the U.S. (7%) follow. But South Africa’s path is different. Here, incremental innovation matters most. Hybrids represent a pragmatic, tech-driven bridge toward full electrification, tailored to the realities of Mzansi roads and its energy landscape.

As energy reliability improves and government policy evolves, BEVs will inevitably gain ground. But today, it’s hybrids, smart, efficient, and practical that are redefining South Africa’s motoring future.

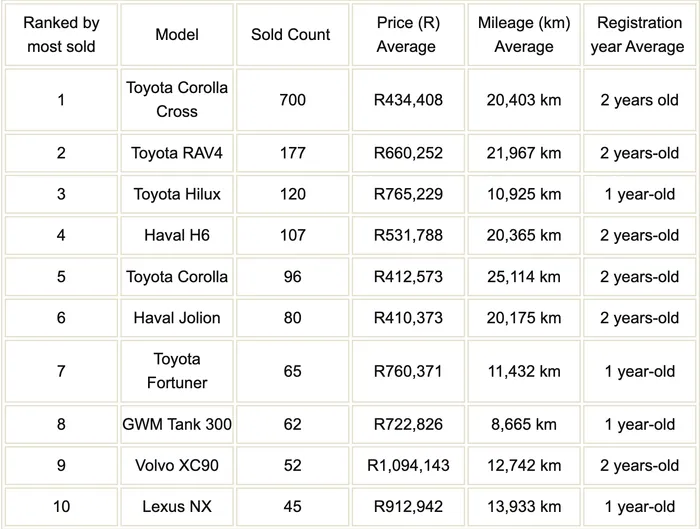

Top 10 Sold Used Hybrid Models Between January and June 2025

Image: Supplied