Ziphozonke Lushaba African News Agency (ANA ARCHIVES) The Office of the Tax Ombud has reported a significant surge in the hijacking of eFiling profiles

Image: Ziphozonke Lushaba/Indepedent Newspapers

The Office of the Tax Ombud has reported a significant surge in the hijacking of eFiling profiles, raising serious concerns about taxpayer security.

Earlier this year, OTO secured approval from the Minister of Finance to investigate the growing number of eFiling profile hijackings.

According to the ombud, this decision followed a surge of complaints from taxpayers and tax practitioners frustrated with SARS’s alleged slow and ineffective response to these security breaches.

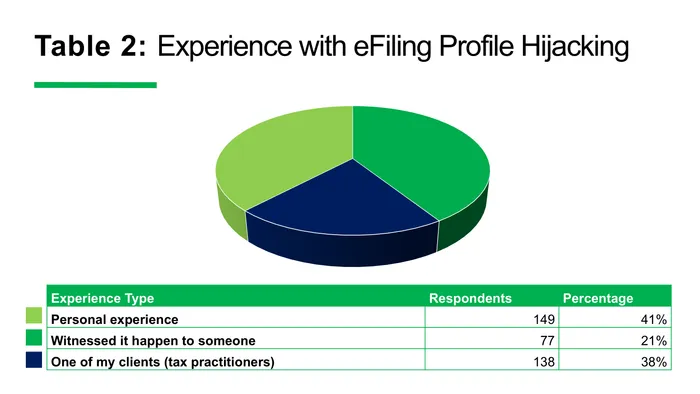

In a statement issued in February this year, the OTO called on taxpayers and their representatives to participate in a national survey aimed at understanding the extent and impact of eFiling profile hijackings.

According to the survey, 48% of tax practitioners and 32% of individual taxpayers were targeted by hijackers. In contrast, those using tax practitioners were less affected, with only 14% of individuals and 5% of companies reporting incidents.

“Because taxpayers represent multiple taxpayer accounts, which require them to log into various taxpayer profiles. This frequent switching in and out of multiple profile accounts elevates the access of e-filing profile hijacking," Tax Ombud's Yanga Mputa said to the public broadcaster SABC.

According to the survey, 48% of tax practitioners and 32% of individual taxpayers were targeted by hijackers

Image: Tax Ombud

"This makes them easy targets. Another issue is the target value, whereby if one tax practitioner logs in, it gives profile hijackers a lot of access to other taxpayers.”

Last year, media reports showed several cases of eFiling profile hijackings, including one involving a company’s profile. However, SARS Commissioner Edward Kieswetter said that their investigations found no negligence on the part of SARS.

"SARS has investigated this matter and we have found that no negligence or liability can be imputed to SARS, meaning that SARS can therefore not be held liable for the criminal action," Kieswetter said at the time

“SARS will assist the company and all law enforcement agencies in any investigations that must follow to uncover the source of this tax crime.”

According to reports, OTO is in the process of finalising a draft report that examines the root causes of the profile hijackings.

Related Topics: