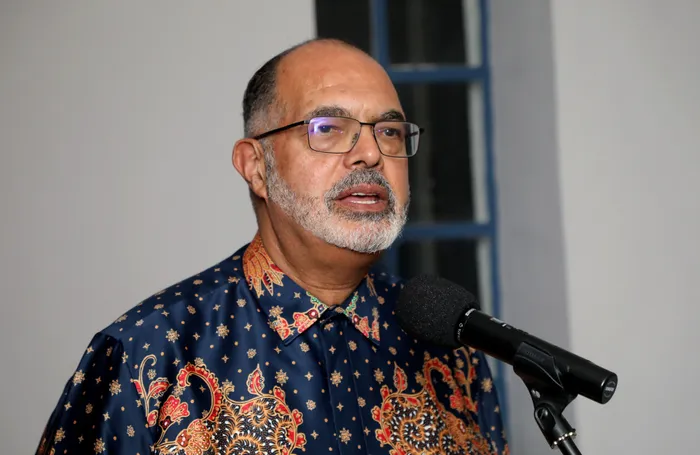

SARS Commissioner Edward Kieswetter.

Image: Timothy Bernard

South African Revenue Service (SARS) commissioner Edward Kieswetter is in discussions with Finance Minister Enoch Godongwana and President Cyril Ramaphosa about stepping down next year, months before his current contract ends.

Ramaphosa extended Kieswetter’s tenure in April 2024 for two years, but internal emails have now confirmed that he will be departing the revenue service.

When Edward Kieswetter took the helm at the Revenue Service in May 2019, he inherited an agency bruised by state capture, demoralised personnel, and gutted institutional capacity. What followed was a rapid pivot toward digital modernisation, powered by ambitious tech overhauls and a data-first mindset.

Amid the COVID-19 pandemic, SARS introduced over 30 new digital functionalities as part of its Vision 2024 strategy.

These included automated personal income tax registrations, VAT registration notices via e-filing, streamlined banking verification via AI-enhanced data matching (servicing over 14,800 taxpayers), email integration with case management for remote query resolution, and an online appointments system to reduce branch visits.

SARS accelerated migration from obsolete Flash-based forms to HTML5, ensuring access across devices for major tax types, personal, corporate, VAT, trusts, PAYE, excise, and tax compliance status forms, according to ITWEB.

By 2024, SARS’s filings had evolved into a largely automated, "non-event" experience, powered by AI and machine learning to pre-populate returns using nearly 150 million third-party data records.

Kieswetter described data as “the new gold,” with over 132 million data records aggregated (up from 123 million) from employers, financial institutions, retirement funds, and medical schemes. These data pools underpin SARS’s machine learning algorithms for auto-assessment and non-compliance detection.

SARS also deployed AI and data models to risk-profile taxpayers, reducing queues by resolving issues proactively and to combat fraudulent refund claims. This led to the recovery or prevention of over R101 billion in impermissible refunds in one financial year.

Lastly, under Kieswetter's tenure, SARS used AI and enhanced ML to handle massive volumes of third-party data to improve return integrity, automate assessments, and streamline filings so that “tax eventually just happens” for millions of South Africans.