.

Image: RON

Artificial intelligence remains the defining force in venture capital this year, and new data suggests investor enthusiasm is only accelerating.

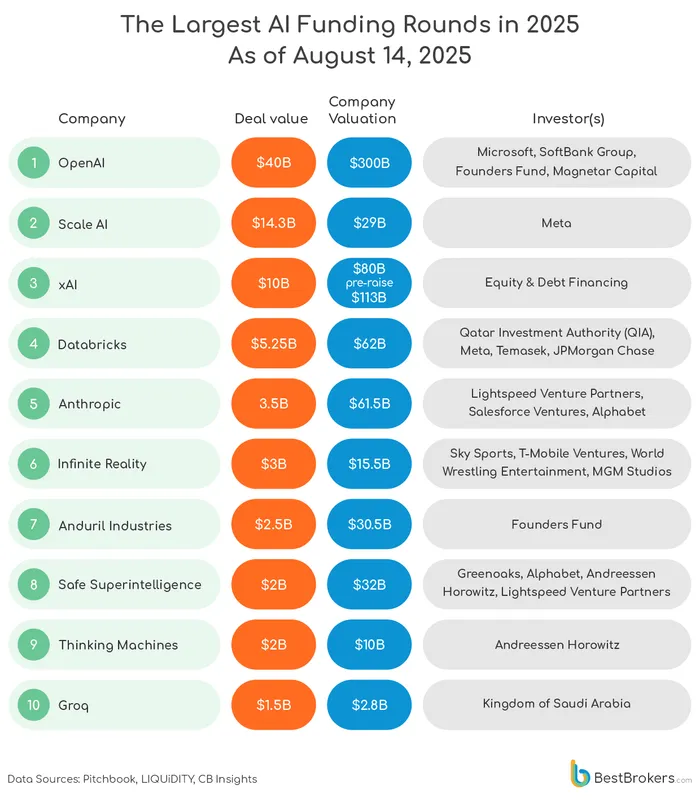

According to research platform BestBrokers, citing figures from Pitchbook, CB Insights, and other sources, “AI startups have attracted at least $121.9 billion in funding within the first six months of the year.”

That total is already within striking distance of 2024’s full-year figure of $142.7 billion, underscoring how quickly capital is flowing into the sector.

Startups building everything from AI infrastructure and developer tools to consumer-facing applications are drawing record attention from investors eager to back the next wave of technological disruption.

Leading the charge is OpenAI, the developer behind ChatGPT.

BestBrokers highlights what it calls “the largest funding in history”, a $40 billion deal valuing the company at $350 billion.

Now, the company is preparing a secondary stock sale that could allow employees to cash out and bring in new investors, including SoftBank and Thrive Capital.

“The $6-billion sale could easily push OpenAI’s valuation to $500 billion,” the BestBrokers team notes. If that happens, OpenAI would surpass SpaceX and Bytedance to become the most valuable private company in the world.

SpaceX, currently valued at $350 billion, is reportedly preparing its own insider sale that could raise its valuation to $400 billion.

Meanwhile, TikTok’s parent company Bytedance hit $315 billion earlier this year through a buyback sale. Both numbers highlight the massive capital flowing into disruptive technology companies, though they remain well short of Meta, whose $1.9 trillion market cap is powered by its 3.1 billion global users.

By comparison, OpenAI’s user base is smaller but growing quickly. Hundreds of millions of people now rely on ChatGPT, while enterprises and developers are adopting its API and enterprise products. That dual consumer-and-business model could explain why investors are assigning such lofty valuations.

BestBrokers’ report also places these developments in a wider context. In the first half of 2025 alone, there were 4,835 venture capital deals worldwide. North America accounted for 35% of them, but “attracted close to two-thirds (63.3%) of all venture capital raised within these six months, a total of $229.9 billion.”

That concentration highlights how U.S. and Canadian startups, particularly in AI remain the epicenter of global venture capital.

It also reflects the current belief among investors that AI is not just another technology trend but a foundational platform, much like the internet or mobile computing before it.

While private market valuations are always fluid, often determined through insider sales rather than public market pricing, the trajectory is clear: AI companies are capturing more attention, more capital, and more confidence than almost any other sector.

The $121.9 billion raised in just six months suggests a strong momentum that could see AI investment easily break records again this year.

At the same time, some of the largest funding rounds, like OpenAI’s, involve complex mixes of strategic partnerships and financing structures rather than straightforward equity injections. That makes direct comparisons with companies like SpaceX or Bytedance more complicated.

.

Image: Supplied

Still, the numbers signal a broader truth. AI is driving not just technological innovation but also capital markets, corporate strategies, and even employee compensation as companies offer liquidity through stock sales.

Whether valuations of $350 billion or $500 billion ultimately hold up, the level of investor interest suggests AI will remain at the centre of the conversation for years to come.

For now, BestBrokers’ findings capture the moment well: a global investment landscape where artificial intelligence isn’t just another category, it’s the category.