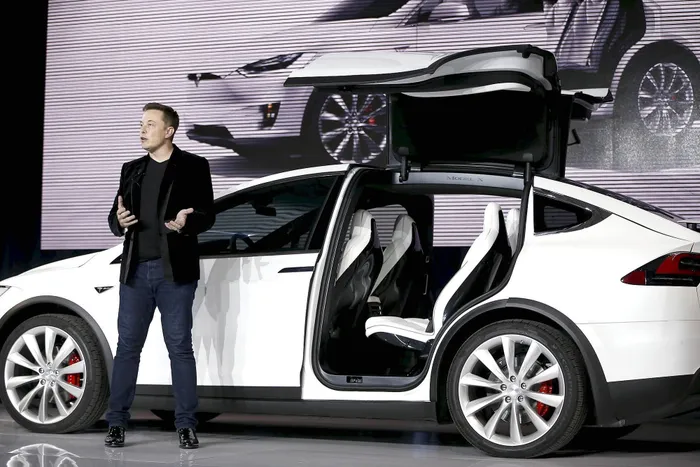

Tesla Motors CEO Elon Musk.

Image: File

As the so-called Magnificent Seven report solid earnings on the back of a continuing artificial intelligence wave, Tesla is leading the charge.

The electric vehicle car, founded by billionaire Elon Musk 12 years ago, is up 5.67% as of Wednesday, although this is 14.02% lower than the start of the year.

According to Investing.com, Tesla is outperforming other Magnificent 7 stocks – Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla. Its shares are gaining after Musk, once US President Donald Trump’s “best buddy,” posted that he regretted some of the things he recently wrote on X, which he also owns.

"I regret some of my posts about President @realDonaldTrump last week. They went too far," Musk said. The billionaire also called for Trump’s impeachment.

Tesla share price on June 11

Image: Google

Musk and Trump had a very public falling out last week, with Musk posting "@realDonaldTrump is in the Epstein files. That is the real reason they have not been made public." Sky News reported at the time that Tesla stocks lost $150 billion due to the fall out between the two.

Trump retaliated, stating on his own media platform that "Elon was 'wearing thin,' I asked him to leave, I took away his EV mandate that forced everyone to buy electric cars that nobody else wanted (that he knew for months I was going to do!), and he just went crazy!".

The spat was caused by Musk’s dismay at a Bill, which would result in billions in tax breaks, passing through the House of Commons. The proposed law is a pet project of Trump’s and he refers to it as the "big, beautiful bill".

The Magnificent 7 group of technology stocks have significantly underperformed so far this year, according to John Flood, head of Americas equities sales trading at Goldman Sachs. This, he said, comes after two years of them leading the US markets higher.

Yet, Flood said in a recent podcast that Goldman Sachs is taking a contrary view to that of some investors, who are asking whether the stocks are overvalued. “You even get the word ‘bubble’ thrown around,” he said.

“We see it differently. These companies just reported outstanding earnings, beating estimates by 13%. With rising earnings and falling stock prices, valuations are becoming much more reasonable,” Flood said.

Flood stated that the valuation premium of these companies is falling and are well set up from an economic perspective. “They are less reliant on economic growth, which means they can become defensive during uncertain times,” he said.

The Organisation for Economic Development (OECD) recently downgraded its forecast for economic growth, dropping it from 3.1% for this year to 2.9%. It said that this assumes that tariff rates as of mid-May are sustained, which was just before Trump started negotiations with major trading partners to drop import duties, which he initially announced on April 2 – “Liberation Day”.

According to the OECD’s predictions, the slowdown in economic growth is concentrated in the United States, Canada, Mexico and China. It anticipated economic gains in the US of just 1.1%, which is ahead of many expectations that the country will fall into a recession.

“Put it all together, and I’m looking for the Magnificent 7 to outperform the broader market this [northern hemisphere] summer,” said Flood.