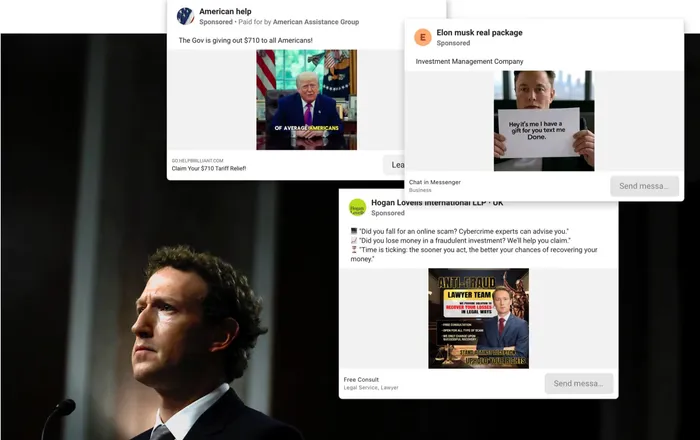

Meta CEO Mark Zuckerberg testifying before the U.S. Senate Judiciary Committee in January 2024. The company is under regulatory pressure on a number of fronts, including ads for scams on its platforms.

Image: Ad screenshots via Reuters. Zuckerberg photo: REUTERS/Evelyn Hockstein

Meta internally projected late last year that it would earn about 10% of its overall annual revenue – or $16 billion – from running advertising for scams and banned goods, internal company documents show.

A cache of previously unreported documents reviewed by Reuters also shows that the social-media giant for at least three years failed to identify and stop an avalanche of ads that exposed Facebook, Instagram and WhatsApp’s billions of users to fraudulent e-commerce and investment schemes, illegal online casinos, and the sale of banned medical products.

On average, one December 2024 document notes, the company shows its platforms’ users an estimated 15 billion “higher risk” scam advertisements – those that show clear signs of being fraudulent – every day.

Meta earns about $7 billion in annualised revenue from this category of scam ads each year, another late 2024 document states.

Much of the fraud came from marketers acting suspiciously enough to be flagged by Meta’s internal warning systems.

But the company only bans advertisers if its automated systems predict the marketers are at least 95% certain to be committing fraud, the documents show. If the company is less certain – but still believes the advertiser is a likely scammer – Meta charges higher ad rates as a penalty, according to the documents.

The idea is to dissuade suspect advertisers from placing ads. The documents further note that users who click on scam ads are likely to see more of them because of Meta’s ad-personalisation system, which tries to deliver ads based on a user’s interests.

The details of Meta’s confidential self-appraisal are drawn from documents created between 2021 and this year across Meta’s finance, lobbying, engineering and safety divisions.

Together, they reflect Meta’s efforts to quantify the scale of abuse on its platforms – and the company’s hesitancy to crack down in ways that could harm its business interests.

Meta’s acceptance of revenue from sources it suspects are committing fraud highlights the lack of regulatory oversight of the advertising industry, said Sandeep Abraham, a fraud examiner and former Meta safety investigator who now runs a consultancy called Risky Business Solutions.

If regulators wouldn’t tolerate banks profiting from fraud, they shouldn’t tolerate it in tech,” he told Reuters.In a statement, Meta spokesman Andy Stone said the documents seen by Reuters “present a selective view that distorts Meta’s approach to fraud and scams.”

The company’s internal estimate that it would earn 10.1% of its 2024 revenue from scams and other prohibited ads was “rough and overly-inclusive,” Stone said.

The company had later determined that the true number was lower, because the estimate included “many” legitimate ads as well, he said. He declined to provide an updated figure.

“The assessment was done to validate our planned integrity investments – including in combating frauds and scams – which we did,” Stone said.

He added: “We aggressively fight fraud and scams because people on our platforms don’t want this content, legitimate advertisers don’t want it and we don’t want it either.”

"Over the past 18 months, we have reduced user reports of scam ads globally by 58 percent and, so far in 2025, we’ve removed more than 134 million pieces of scam ad content,” Stone said.

Some of the documents show Meta vowing to do more. "We have large goals to reduce ad scams in 2025," states a 2024 document, with Meta hoping to reduce such ads in certain markets by as much as 50%.

In other places, documents show managers congratulating staffers for successful scam reduction efforts.

At the same time, the documents indicate that Meta’s own research suggests its products have become a pillar of the global fraud economy.

A May 2025 presentation by its safety staff estimated that the company’s platforms were involved in a third of all successful scams in the U.S. Meta also acknowledged in other internal documents that some of its main competitors were doing a better job at weeding out fraud on their platforms.

“It is easier to advertise scams on Meta platforms than Google,” concluded an internal Meta review in April 2025 of online communities where fraudsters discuss their trade.

The document doesn’t lay out the reasons behind that conclusion.

The insights from the documents come at a time when regulators worldwide are pushing the company to do more to protect its users from online fraud. In the U.S., the Securities and Exchange Commission is investigating Meta for running ads for financial scams, according to the internal documents.

In Britain, a regulator last year said it found that Meta’s products were involved in 54% of all payment-related scam losses in 2023, more than double all other social platforms combined. The SEC and the UK regulator didn’t respond to questions for this report.

Meta’s Stone referred Reuters to the company’s latest SEC disclosures, which state that the company’s efforts to address illicit advertising “adversely affect our revenue, and we expect that the continued enhancement of such efforts will have an impact on our revenue in the future, which may be material.”

FAST COMPANY