.

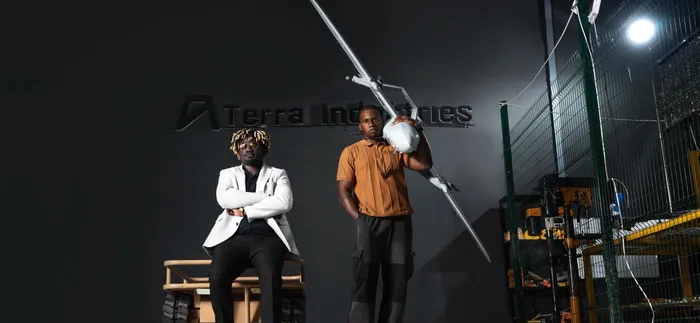

Image: Terra Industries

Africa’s defence technology industry has historically been shaped by imports, equipment, software, and intelligence systems designed elsewhere, sold back to governments and infrastructure operators on the continent.

Now, a new player is trying to reverse that flow.

Terra Industries, a Nigerian-founded defence technology startup, has rapidly emerged as one of the continent’s most closely watched deep-tech companies after raising more than $34 million (R639 million) across two back-to-back rounds, an unusually large sum for African defence technology.

The headline, however, isn’t just the amount raised. It’s who is writing the cheques.

Behind Terra’s rise is a cluster of powerful Silicon Valley funds, defence-focused investors, and strategic operators with direct links to some of the most influential names in modern military technology, including figures tied to Palantir Technologies and fintech giant Flutterwave.

And that raises an important question: Why are investors who helped shape global defence and fintech betting on an African defence startup now?

Founded in 2024 by Nigerian entrepreneurs Nathan Nwachuku and Maxwell Maduka, Terra Industries builds autonomous defence and surveillance systems, drones, monitoring towers, and software designed to protect critical infrastructure such as power plants, mining facilities and energy assets.

The company says its systems are already deployed at infrastructure sites across Nigeria and Ghana, protecting assets valued at roughly $11 billion (R207 billion).

Terra’s ambition is bold: to build what it calls Africa’s first “defence prime,” essentially a vertically integrated defence manufacturer capable of producing technology locally rather than importing it.

But Terra’s story is increasingly less about hardware and more about capital.

The first major funding round, $11.75 million (R221 million), was led by 8VC, a venture capital firm founded by Palantir co-founder Joe Lonsdale.

Here’s where things get interesting: Palantir is not exactly a venture capitalist.

Palantir itself is a publicly listed software and analytics company known for building intelligence platforms used by governments, militaries, and security agencies worldwide. It sells software — not startup equity.

However, Palantir’s founders and senior executives have helped create a broader investment ecosystem, often referred to informally as the R221 million“Palantir mafia”, where alumni and associates fund new defence and AI startups.

8VC sits squarely inside that orbit.

The firm invests heavily in defence technology, logistics, AI, and critical infrastructure, sectors where software and hardware intersect. Terra fits that profile perfectly.

Three factors help explain why Palantir-linked investors are backing Terra Industries. First is geopolitical opportunity: defence-technology investment is expanding worldwide as governments look to reduce reliance on foreign suppliers. Africa, facing growing security pressures while simultaneously investing heavily in infrastructure, represents a largely untapped market for locally developed defence solutions.

Second is vertical integration. Terra combines hardware, software and manufacturing under one roof, a model increasingly favoured by Silicon Valley investors backing the next generation of defence startups.

Third is strategic alignment: Alex Moore, an 8VC partner and a Palantir board director, joining Terra’s board signals deep strategic involvement rather than passive funding. Taken together, the investment is clearly not charity capital. It reflects a calculated bet that Africa will evolve from being a consumer of defence technology into a producer of it.

The first round also included a heavy lineup of global venture firms:

Lux Capital — known for frontier and deep-tech investments.

Valor Equity Partners — growth investor with ties to industrial and technology companies.

SV Angel — a well-known Silicon Valley seed-stage firm.

Nova Global, Silent Ventures, Leblon Capital — investors focused on early-stage technology with global applications.

Just one month later, Terra announced another $22 million round, led by Lux Capital, with repeat participation from earlier backers.

The speed of this follow-on round, completed in under two weeks, suggests investor urgency driven by traction and early contracts.

One of the more surprising names in the latest round was Resilience17 Capital, a fund founded by Flutterwave CEO Olugbenga Agboola.

This move signals a new trend: African fintech wealth flowing into deep-tech and defence.

FAST COMPANY (SA)